- info@advisordaddy.com

- +91-9654312612

- Business Startup

Business Registration

Partnership Firm

Company incorporation

- LICENSES

BUSINESS LICENSE

Food license

Labour License

- BUSINESS COMPLIANCE

BUSINESS COMPLIANCE

- NGO

- Blogs

- CONTACT US

GST registration not only helps you in getting your business recognized as a legal registrant but also opens a number of opportunities for your business. Benefits to GST registered business at glance are as follows

| Composition Scheme | Regular Scheme | |

|---|---|---|

| Compliance | Relaxed Compliance in order to safeguard small businessmen. | Normal compliance required. |

| GST Return Filing | Composition taxpayers required to file quarterly return. | Normal taxpayers required to file monthly return. |

| Input Tax Credit | Composition taxpayers cannot avail Input tax credit benefit. | Normal taxpayers can avail Input tax credit benefit. |

| Tax Invoice | Composition taxpayers can not issue tax invoice to their customers. | Normal taxpayers can issue tax invoice to their customers. |

| Tax Rate | Composition taxpayers need to pay nominal GST at a fixed rate of turnover, which is normally 1-5%. | Tax rate for regular taxpayers goods and services, which is from 0-28%. |

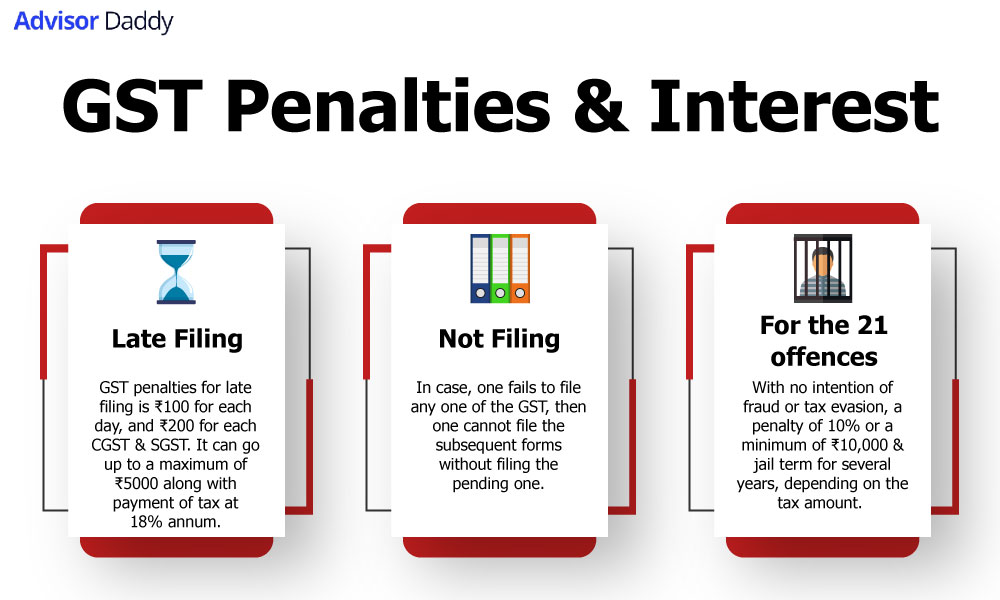

GST Return Filing is a return document that contains details of the income of the taxpayer. It has to be filed with the GST administrative authority. The document is used tax authorities to calculate the tax liability of a GST taxpayer. A GST Return Filing form has to include the following details.

For filing a GST Return, you need to have GST compliant sales and purchase invoices attached.

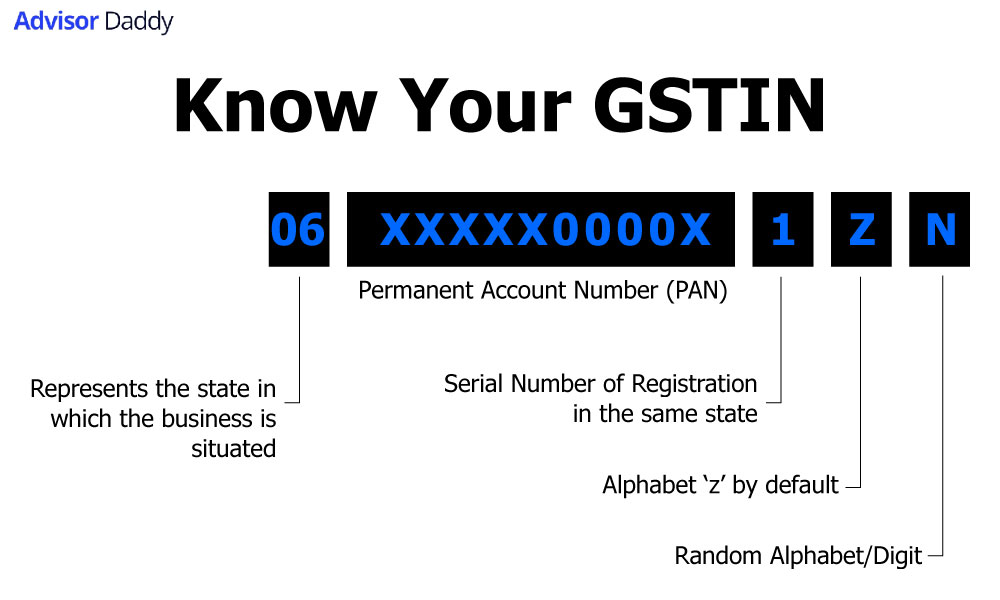

With annual turn over of 20 lacs/40 Lac/10 Lac (as the case applicable) would require the for GST registration and have a valid GST Number